There are also slight variations of the EMA arrived at by using the open, high, low, or median price instead of using the closing price. For example, an 18.18% multiplier is applied to the most recent price data for a 10-period EMA, while the weight is only 9.52% for a 20-period EMA. The weighting given to the most recent price is greater for a shorter-period EMA than for a longer-period EMA. The EMA gives a higher weight to recent prices, while the SMA assigns equal weight to all values.

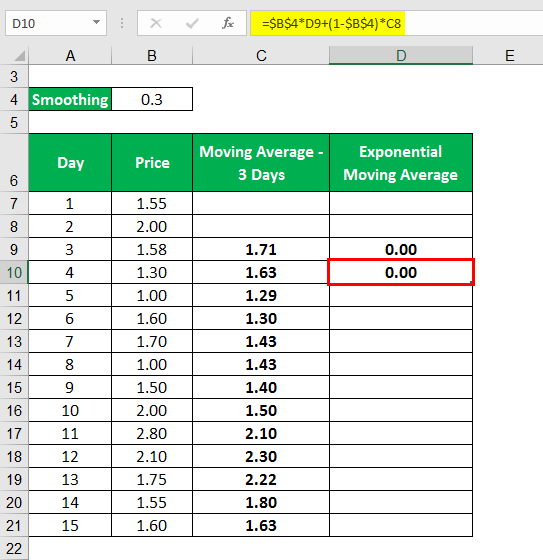

EMA = Closing price x multiplier + EMA (previous day) x (1-multiplier).Finally, the following formula is used to calculate the current EMA: For a 20-day moving average, the multiplier would be = 0.0952. Next, you must calculate the multiplier for smoothing (weighting) the EMA, which typically follows the formula. For example, a 20-day SMA is just the sum of the closing prices for the past 20 trading days, divided by 20. It is simply the sum of the stock's closing prices during a time period, divided by the number of observations for that period. The calculation for the SMA is straightforward. On the 21st day, you can then use the SMA from the previous day as the first EMA for yesterday. Then, you must wait until the 20th day to obtain the SMA. Suppose that you want to use 20 days as the number of observations for the EMA. If the smoothing factor is increased, more recent observations have more influence on the EMA.Ĭalculating the EMA Calculating the EMA requires one more observation than the SMA. That gives the most recent observation more weight. While there are many possible choices for the smoothing factor, the most common choice is:

EMAToday=(ValueToday∗(1+DaysSmoothing))+ EMAYesterday∗(1−(1+DaysSmoothing)) where: EMA=Exponential moving average

The EMA is a moving average that places a greater weight and significance on the most recent data points.An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average simple moving average (SMA), which applies an equal weight to all observations in the period. The exponential moving average is also referred to as the exponentially weighted moving average. What Is an Exponential Moving Average (EMA)?Īn exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points.

0 kommentar(er)

0 kommentar(er)